Kicking off with USAA Bundle Insurance, this opening paragraph is designed to captivate and engage the readers, highlighting the benefits of bundling different types of insurance with USAA, leading to cost savings, additional perks, and discounts for policyholders. Exploring the various types of insurance offered for bundling, the coverage options available, and steps to bundle insurance with USAA will provide a comprehensive overview of this topic. Real-life customer reviews and experiences will also be shared to give insight into customer satisfaction levels and common feedback.

Benefits of USAA Bundle Insurance

When it comes to USAA Bundle Insurance, there are numerous advantages that policyholders can enjoy. One of the key benefits is the ability to bundle different types of insurance policies together under one provider, which can lead to cost savings and added convenience for customers.

Cost Savings

By bundling multiple insurance policies such as auto, home, and life insurance with USAA, policyholders can often qualify for significant discounts on their premiums. This can result in overall cost savings compared to purchasing individual policies from different providers.

Convenience

Having all of your insurance policies with one provider like USAA can make managing your coverage easier and more convenient. From making payments to filing claims, having a single point of contact for all your insurance needs can save you time and hassle.

Additional Perks and Discounts

In addition to the cost savings from bundling policies, USAA may offer further perks and discounts to policyholders who choose to bundle. These could include things like multi-policy discounts, accident forgiveness programs, or even rewards for loyalty to the company.

Types of Insurance Offered by USAA for Bundling

When it comes to bundling insurance policies with USAA, customers have a variety of options to choose from. By combining different types of insurance, individuals can enjoy comprehensive coverage and potential cost savings. Let’s explore the types of insurance offered by USAA for bundling and the coverage options available for each.

Auto Insurance

USAA provides auto insurance coverage that includes liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. By bundling auto insurance with other policies, customers can enjoy discounts and a streamlined insurance experience.

Homeowners Insurance

For homeowners, USAA offers insurance coverage for the structure of the home, personal belongings, liability protection, and additional living expenses. Bundling homeowners insurance with other policies can lead to savings and simplified management of insurance needs.

Renters Insurance

USAA’s renters insurance provides coverage for personal belongings, liability protection, and additional living expenses in case of a covered loss. Bundling renters insurance with other policies can offer peace of mind and potential discounts.

Life Insurance

USAA offers various life insurance options, including term life, whole life, and universal life insurance. By bundling life insurance with other policies, customers can protect their loved ones financially while potentially saving on premiums.

Other Insurance Products

In addition to the above, USAA also offers umbrella insurance, valuable personal property insurance, and more. Bundling these insurance products together can provide comprehensive coverage across various aspects of life and assets.

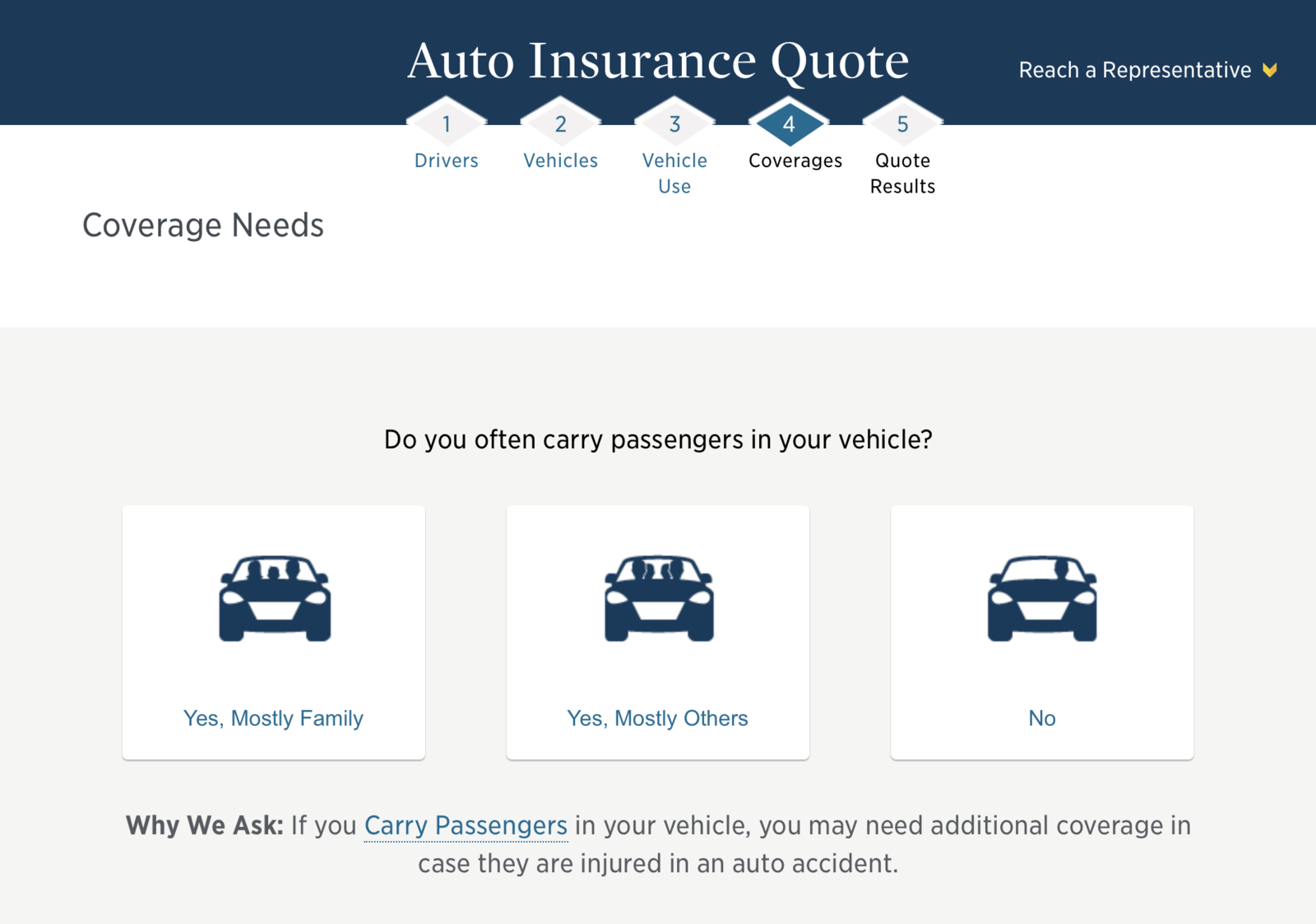

Steps to Bundle Insurance with USAA: Usaa Bundle Insurance

When it comes to bundling insurance policies with USAA, the process is straightforward and can help you save money while streamlining your coverage. Here is a step-by-step guide on how to bundle insurance with USAA:

1. Assess Your Insurance Needs

Before you begin the bundling process, take some time to evaluate your insurance needs. Determine which policies you want to bundle together, such as auto and home insurance.

2. Contact USAA

Reach out to USAA either by phone or online to inquire about bundling your insurance policies. A representative will guide you through the process and provide information on available discounts.

3. Provide Information, Usaa bundle insurance

You will need to provide information about your current insurance policies and coverage levels. This will help USAA tailor a bundled insurance package that meets your specific needs.

4. Obtain a Quote

Once USAA has all the necessary information, they will provide you with a bundled insurance quote. This quote will Artikel the coverage options and premiums for the bundled policies.

5. Review and Finalize

Take the time to review the bundled insurance quote carefully. Make sure you understand the coverage details, deductibles, and premiums before finalizing the bundling process with USAA.

6. Documentation and Signatures

If you decide to proceed with the bundled insurance package, you may need to sign some documents to formalize the agreement. USAA will guide you through the necessary paperwork to complete the bundling process.

By following these steps, you can easily bundle your insurance policies with USAA and enjoy the benefits of consolidated coverage and potential savings.

Customer Reviews and Experiences with USAA Bundle Insurance

When it comes to customer reviews and experiences with USAA Bundle Insurance, many policyholders have shared positive feedback about their bundled insurance offerings. These reviews highlight the convenience, cost savings, and overall satisfaction with combining multiple insurance policies under one provider like USAA.

Real-life Stories and Testimonials

- One customer mentioned that bundling their auto and home insurance with USAA not only saved them money but also made managing their policies much easier.

- Another policyholder shared how the customer service at USAA was exceptional when they needed to file a claim for both their auto and renters insurance policies.

- A different review highlighted the peace of mind that comes from having all insurance needs taken care of by a reputable company like USAA.

Customer Satisfaction Levels

- Overall, customers appear to be highly satisfied with the bundled insurance offerings provided by USAA, citing competitive rates and comprehensive coverage options.

- Many policyholders appreciate the personalized service and attention to detail they receive when bundling their insurance policies with USAA.

Common Feedback and Experiences

- Common feedback from customers includes the ease of bundling multiple policies, the convenience of a single point of contact for all insurance needs, and the potential for additional discounts.

- Customers often report a seamless claims process and responsive customer support when dealing with USAA for their bundled insurance policies.

Final Thoughts

In conclusion, USAA Bundle Insurance offers a convenient way to bundle different types of insurance, maximizing savings and coverage options for policyholders. The testimonials and experiences shared by customers highlight the satisfaction levels and benefits of choosing USAA for bundled policies. Whether you’re looking to save money or streamline your insurance needs, bundling with USAA could be the right choice for you.

Common Queries

What are the advantages of bundling insurance with USAA?

By bundling different types of insurance with USAA, policyholders can enjoy cost savings, additional perks, and discounts.

How can I bundle insurance with USAA?

You can bundle insurance with USAA by following a step-by-step guide provided by them, obtaining a quote for bundled insurance, and completing any necessary requirements or documentation.

What types of insurance products does USAA offer for bundling?

USAA offers various insurance products such as auto, home, renters, and life insurance that can be bundled for added convenience and savings.

Are there any customer discounts for bundled policies?

Yes, USAA offers discounts and additional perks for policyholders who choose to bundle their insurance with them.