Starting with Humana Medicare Supplement Insurance Plans, this paragraph aims to provide a captivating overview of the extensive coverage options available, tailored to meet individual needs effectively.

Delving into the intricate details of the plans, this introduction sets the stage for a thorough exploration of the benefits and features offered by Humana.

Overview of Humana Medicare Supplement Insurance Plans

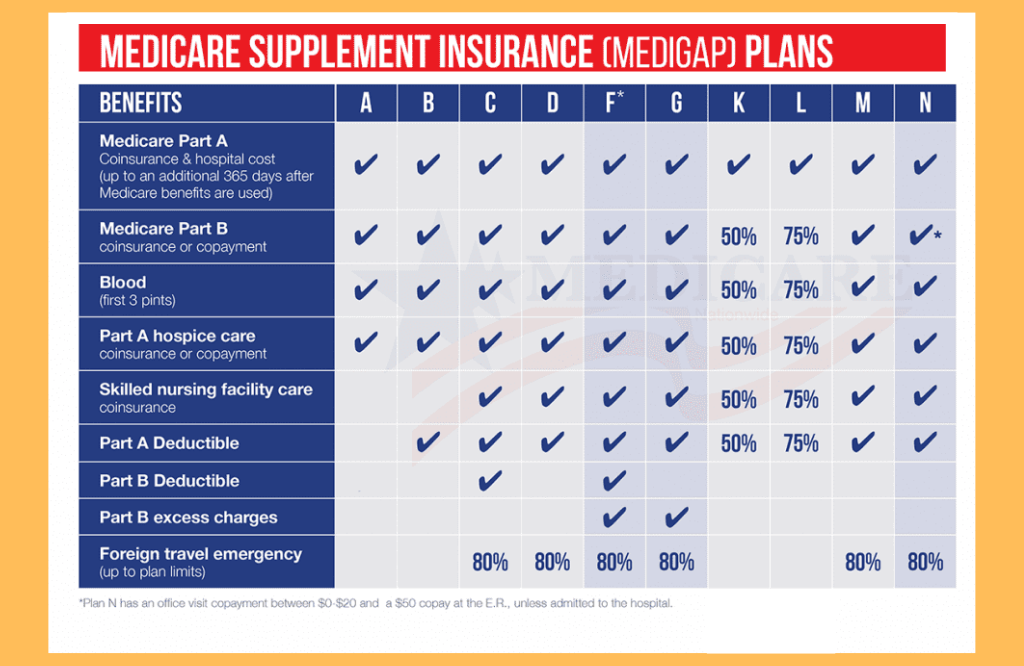

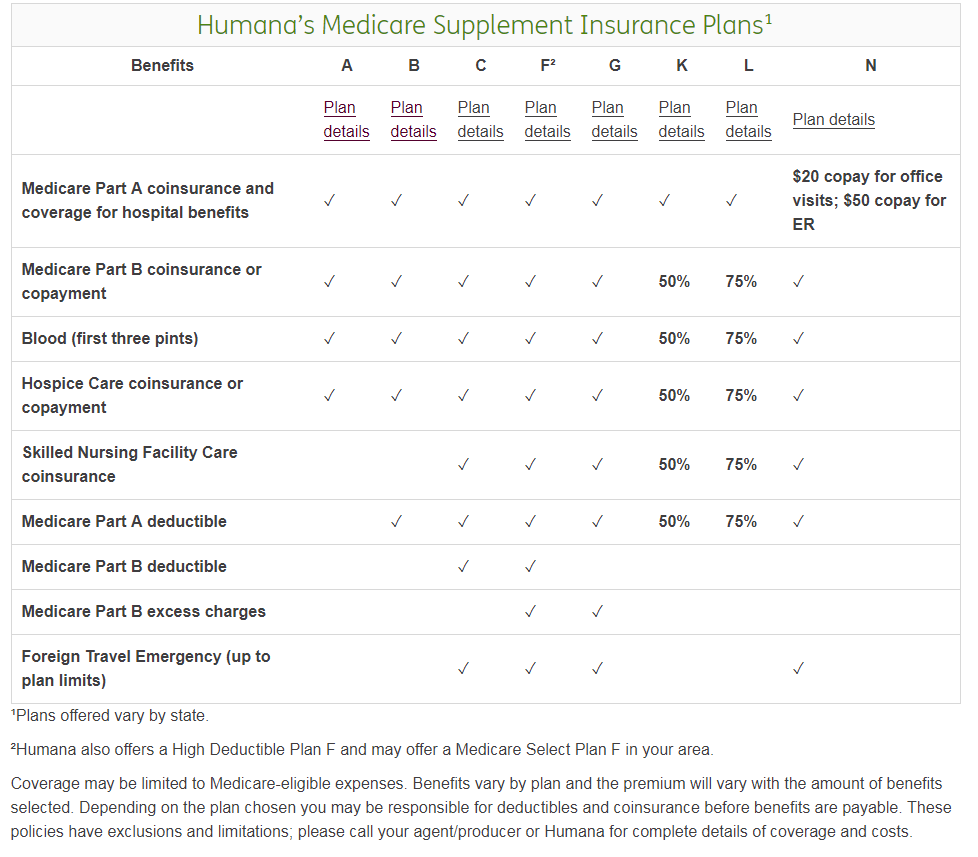

Humana Medicare Supplement Insurance Plans, also known as Medigap plans, are additional insurance policies that individuals can purchase to supplement their Original Medicare coverage. These plans help cover some of the out-of-pocket costs that Original Medicare does not, such as copayments, coinsurance, and deductibles.

Coverage and Benefits

- Humana Medicare Supplement Insurance Plans offer different levels of coverage, ranging from basic benefits to more comprehensive options.

- Some of the common benefits provided by these plans include coverage for Medicare Part A and Part B coinsurance, hospice care coinsurance, and skilled nursing facility care coinsurance.

- Other benefits may include coverage for foreign travel emergencies, excess charges from healthcare providers, and the first three pints of blood for a medical procedure.

Differences from Traditional Medicare

- Unlike Original Medicare, Humana Medicare Supplement Insurance Plans are offered by private insurance companies like Humana and are designed to fill the gaps in coverage left by Medicare.

- These plans are standardized by the federal government, meaning that each plan type offers the same basic benefits, regardless of the insurance company offering it.

- Humana’s plans may also provide additional perks such as gym memberships, vision and dental discounts, and access to telehealth services, which are not typically covered by Original Medicare.

Types of Humana Medicare Supplement Insurance Plans

Humana offers several types of Medicare Supplement Insurance Plans to meet the diverse needs of individuals. Each plan comes with different coverage options and costs, catering to various healthcare requirements.

Plan A

Plan A is the most basic Medicare Supplement Insurance Plan offered by Humana. It covers essential benefits such as Medicare Part A coinsurance and hospital costs, along with Part B coinsurance or copayment.

Plan F

Plan F is a comprehensive option that covers all Medicare deductibles, coinsurance, and copayments. It provides the most extensive coverage among all the plans, making it suitable for individuals who want minimal out-of-pocket expenses.

Plan G

Plan G is similar to Plan F but does not cover the Medicare Part B deductible. However, it offers lower premiums than Plan F while providing extensive coverage for medical expenses, making it a popular choice for many beneficiaries.

Plan N

Plan N is a cost-effective option that requires beneficiaries to pay certain out-of-pocket costs like copayments for doctor visits and emergency room visits. It offers lower premiums compared to Plans F and G, making it suitable for individuals looking for more budget-friendly options.

Enrollment Process for Humana Medicare Supplement Insurance Plans

Enrolling in a Humana Medicare Supplement Insurance Plan involves several steps to ensure you get the coverage you need. Below are the details on how to enroll, eligibility requirements, and important considerations to keep in mind.

Steps to Enroll in a Humana Medicare Supplement Insurance Plan

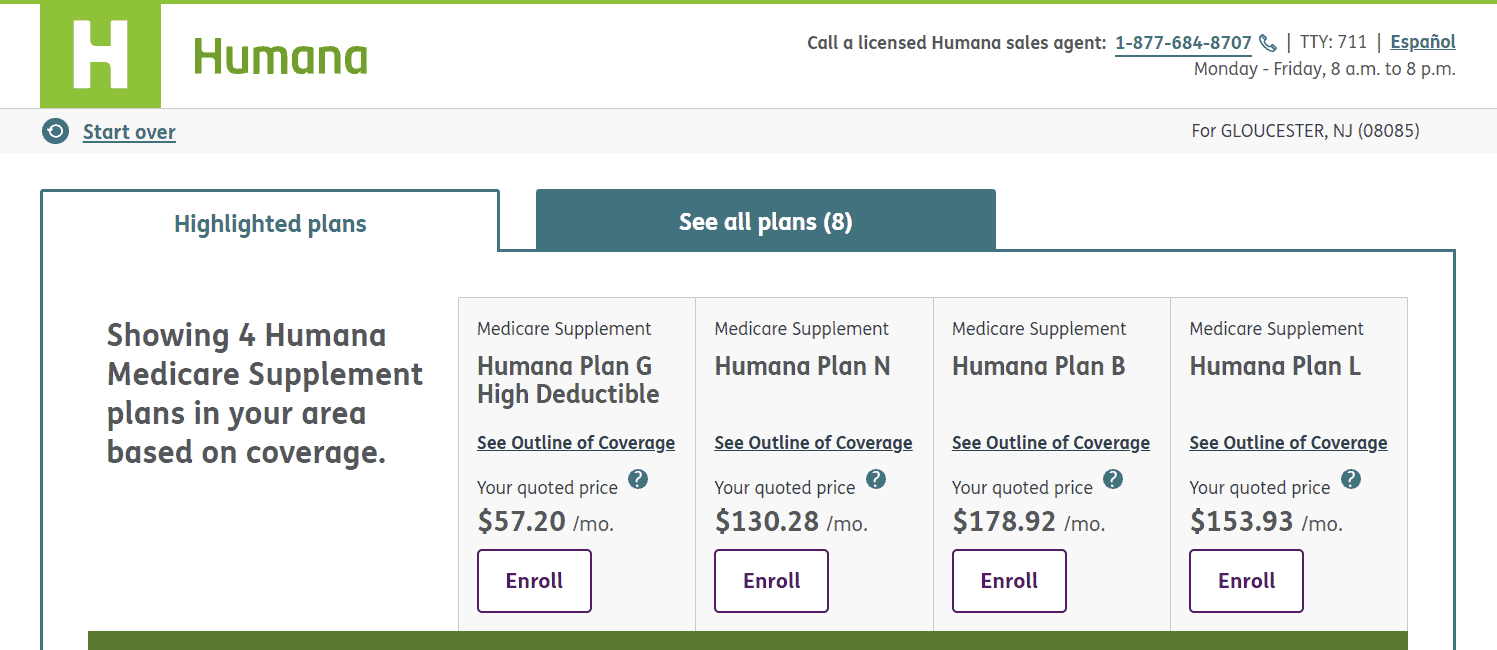

- Choose a Plan: Research and compare the different Humana Medicare Supplement Insurance Plans to find the one that best fits your needs.

- Contact Humana: Reach out to Humana either online or by phone to start the enrollment process.

- Complete Application: Fill out the necessary forms and provide any required information to apply for your selected plan.

- Review and Confirm: Review the details of your chosen plan, including coverage and costs, before confirming your enrollment.

- Payment: Make the initial premium payment to activate your coverage.

Eligibility Requirements for Humana Medicare Supplement Insurance Plans

To be eligible for a Humana Medicare Supplement Insurance Plan, you must meet the following criteria:

- Be enrolled in Medicare Part A and Part B.

- Live in the plan’s service area.

- Not have end-stage renal disease (ESRD) in most cases.

Deadlines and Important Considerations for Enrollment, Humana medicare supplement insurance plans

It’s important to be aware of the following deadlines and considerations when enrolling in a Humana Medicare Supplement Insurance Plan:

- Initial Enrollment Period: The best time to enroll is during your Medigap Open Enrollment Period, which starts the first day of the month you’re 65 or older and enrolled in Medicare Part B.

- Guaranteed Issue Rights: You have guaranteed issue rights in certain situations, such as losing employer coverage or if your Medicare Advantage plan leaves your area.

- Underwriting: If you apply for a plan outside of your initial enrollment period, you may be subject to medical underwriting, which could affect your eligibility and premium costs.

Network Coverage and Provider Options: Humana Medicare Supplement Insurance Plans

When it comes to Humana Medicare Supplement Insurance Plans, it is important to understand how network coverage and provider options work to ensure you have access to the healthcare services you need.

Network Coverage with Humana Medicare Supplement Insurance Plans

- Humana Medicare Supplement Insurance Plans do not have network restrictions, meaning you can typically see any doctor or specialist who accepts Medicare patients.

- This gives you the flexibility to choose your healthcare providers without worrying about staying within a specific network.

- Whether you need to see a primary care physician, a specialist, or receive medical services at a hospital, you can do so with the peace of mind that your Humana Medicare Supplement Insurance Plan will help cover the costs.

Provider Options Available

- Individuals enrolled in Humana Medicare Supplement Insurance Plans have a wide range of provider options to choose from.

- You can see any healthcare provider that accepts Medicare assignment, including doctors, hospitals, and other healthcare facilities.

- Having a broad network of healthcare providers ensures that you can receive the care you need, when you need it, without being limited by a specific network.

Limitations or Restrictions

- While Humana Medicare Supplement Insurance Plans offer flexibility in choosing healthcare providers, it is important to note that you may be responsible for any costs that exceed what Medicare covers.

- Be sure to check with your healthcare providers to confirm that they accept Medicare assignment to avoid any unexpected out-of-pocket expenses.

- Understanding any limitations or restrictions on choosing healthcare providers can help you make informed decisions about your healthcare needs while maximizing the benefits of your Humana Medicare Supplement Insurance Plan.

Costs Associated with Humana Medicare Supplement Insurance Plans

When considering Humana Medicare Supplement Insurance Plans, it is important to understand the costs involved to make an informed decision. These plans typically include premiums, deductibles, and copayments that can impact your overall healthcare expenses. Here is a breakdown of the costs associated with Humana’s Medicare Supplement Insurance Plans:

Premiums

Premiums are the monthly payments you make to maintain your Medicare Supplement Insurance coverage. The cost of premiums can vary depending on the plan you choose, your age, location, and other factors. It is essential to budget for these monthly expenses to ensure continuous coverage.

Deductibles

Deductibles are the amount you must pay out of pocket before your Medicare Supplement Insurance plan starts covering your healthcare costs. Humana offers different deductible options for their plans, so it’s crucial to understand how much you need to pay before your coverage kicks in.

Copayments

Copayments are fixed amounts you pay for covered services after you have met your deductible. These costs can add up, especially if you require frequent medical care. Understanding the copayment structure of your Humana Medicare Supplement Insurance Plan can help you plan and manage your healthcare expenses effectively.

Managing and budgeting for the costs associated with Humana’s Medicare Supplement Insurance Plans requires careful consideration of your healthcare needs and financial situation.

Additional Benefits and Features

Humana’s Medicare Supplement Insurance Plans offer various additional benefits and features to enhance the overall coverage and experience for enrollees.

Wellness Programs and Discounts

- Humana provides access to wellness programs, such as gym memberships, fitness classes, and nutrition counseling, to help enrollees maintain a healthy lifestyle.

- Enrollees may also be eligible for discounts on vision and hearing services, as well as over-the-counter health products.

SilverSneakers Program

The SilverSneakers program is included with some Humana Medicare Supplement plans, offering access to fitness facilities and classes tailored to older adults.

Nurse Advice Line

Enrollees have access to a Nurse Advice Line for medical guidance and assistance, providing a convenient resource for health-related inquiries.

Pharmacy Discounts

- Humana’s Medicare Supplement plans may include discounts on prescription medications at participating pharmacies, helping reduce out-of-pocket costs for enrollees.

Closing Notes

In conclusion, Humana Medicare Supplement Insurance Plans stand out as a reliable choice for those seeking enhanced coverage beyond traditional Medicare, with a focus on flexibility and comprehensive benefits to ensure peace of mind.

FAQ Insights

What additional benefits do Humana Medicare Supplement Insurance Plans offer?

Humana Medicare Supplement Insurance Plans may include benefits such as vision, dental, fitness programs, and more, enhancing the overall coverage experience for enrollees.

Are there any specific restrictions on provider options with Humana Medicare Supplement Insurance Plans?

While Humana offers a wide network of providers, it’s essential to check if your preferred healthcare professionals are within the network coverage to optimize benefits.

How can individuals manage and budget for the costs associated with Humana Medicare Supplement Insurance Plans?

Managing costs involves understanding premiums, deductibles, and copayments. Budgeting effectively can be done by reviewing your healthcare needs and planning accordingly.