Delving into can you cancel claim car insurance, this introduction immerses readers in a unique and compelling narrative. Understanding the process, reasons, and alternatives related to canceling a car insurance claim is crucial for making informed decisions.

Can You Cancel Claim Car Insurance?

When it comes to car insurance claims, circumstances may arise where you may want to cancel a claim. It is important to understand the process involved in cancelling a car insurance claim and the implications it may have on your policy.

Process of Cancelling a Car Insurance Claim

- Contact your insurance provider as soon as possible to inform them of your decision to cancel the claim.

- Provide detailed reasons for wanting to cancel the claim, such as discovering that the damage is less severe than originally thought or deciding to pay for the repairs out of pocket.

- Expect the insurance company to investigate the claim cancellation request and assess the impact on your policy.

Implications of Cancelling a Claim

- Cancelling a claim may not always result in a refund of any deductible paid, as it depends on the terms and conditions of your policy.

- Repeatedly cancelling claims could potentially affect your future insurability and premiums, as insurers may view this behavior as a red flag.

- Be prepared for potential increases in premiums if you have a history of cancelling claims or if the insurance company deems you as a higher risk.

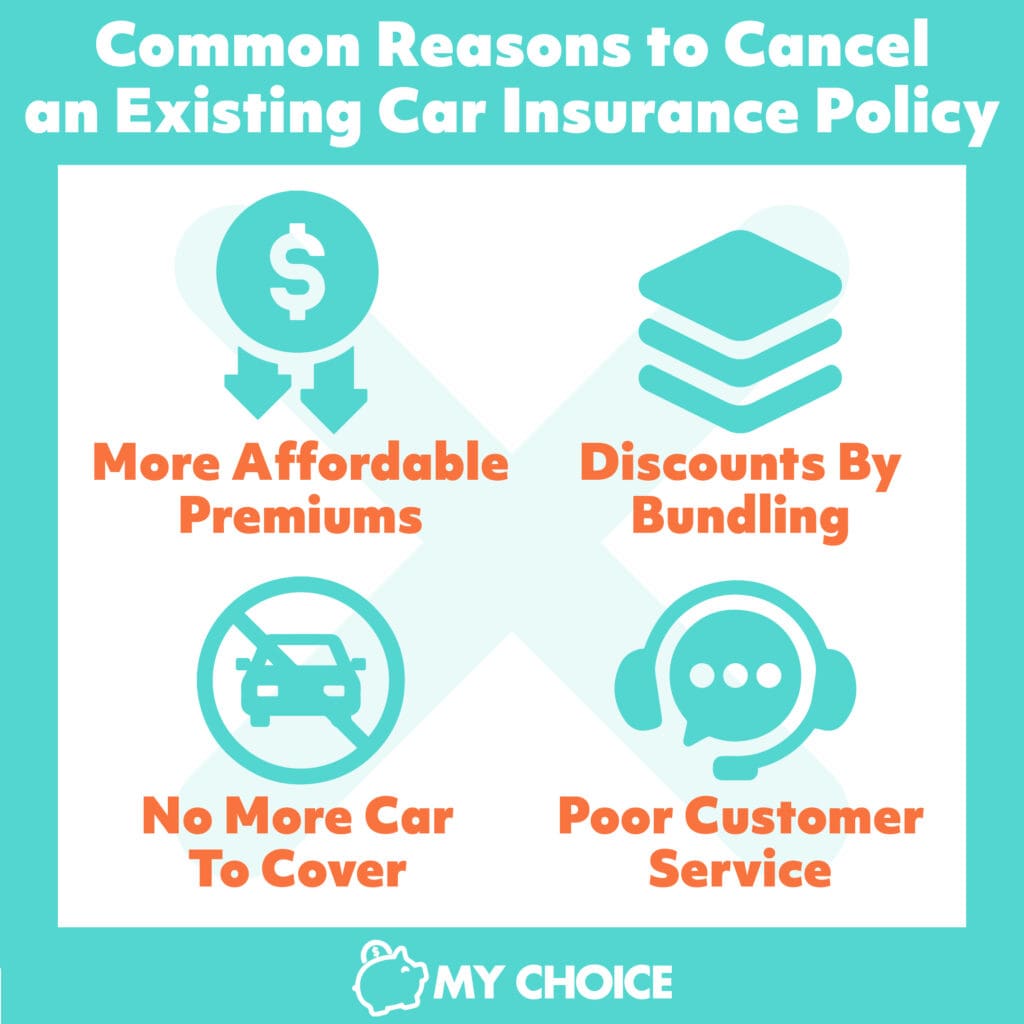

Reasons for Cancelling a Car Insurance Claim

There are various reasons why someone might consider cancelling a car insurance claim. Understanding these reasons can help individuals make informed decisions about how to proceed with their insurance coverage.

Financial Considerations, Can you cancel claim car insurance

- Canceling a claim can help avoid an increase in premiums: When a claim is filed, insurance companies may raise the policyholder’s premium rates. By canceling the claim, individuals can prevent this potential financial burden.

- Out-of-pocket costs: Depending on the deductible amount, individuals may find that paying for repairs or damages out of pocket is more cost-effective than going through the insurance claim process.

Time and Convenience

- Quicker resolution: Canceling a claim can lead to a faster resolution of the issue, as insurance claims can sometimes take a long time to process.

- Less paperwork and hassle: By canceling a claim, individuals can avoid the paperwork and administrative tasks that come with filing an insurance claim.

Policy Considerations

- Protecting policy benefits: Canceling a claim for a minor incident can help preserve the policyholder’s benefits for more significant future claims.

- Preventing policy cancellation: In some cases, filing too many claims can lead to the insurance company canceling the policy. Canceling a claim can help prevent this from happening.

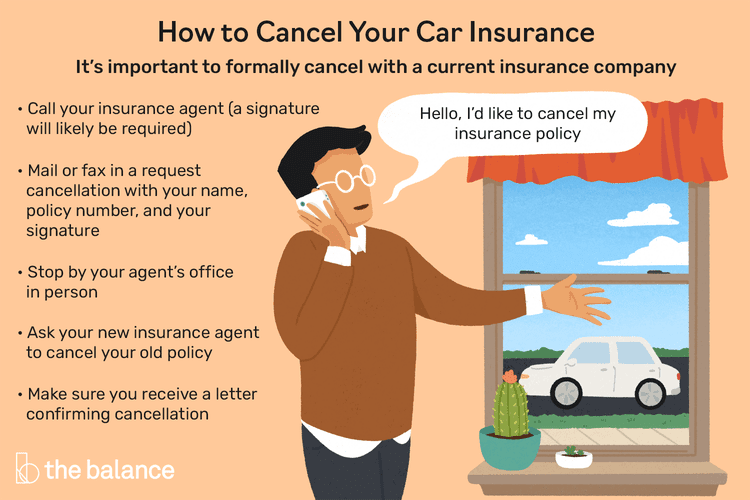

How to Cancel a Car Insurance Claim

When it comes to cancelling a car insurance claim, there are specific steps that need to be followed to ensure a smooth process. Whether you have decided you no longer need to claim or have found an alternative solution, cancelling a car insurance claim requires attention to detail.

Steps to Cancel a Car Insurance Claim:

- Contact Your Insurance Provider: Reach out to your insurance company as soon as possible to inform them of your decision to cancel the claim.

- Provide Necessary Information: Be prepared to provide your policy details, claim number, and reasons for cancellation.

- Submit a Written Request: In some cases, your insurance provider may require a written request for cancellation. Make sure to follow their specific instructions.

- Review Policy Terms: Check your insurance policy to understand any cancellation fees or penalties that may apply. It’s important to be aware of any financial implications.

- Follow Up: Stay in touch with your insurance provider to ensure that the cancellation process is completed successfully. Keep records of all communication.

Tip: It’s crucial to act promptly when cancelling a car insurance claim to avoid any delays or misunderstandings.

Alternatives to Cancelling a Car Insurance Claim: Can You Cancel Claim Car Insurance

While cancelling a car insurance claim may seem like the only option in some cases, there are alternative solutions that can be explored to modify the claim instead of completely cancelling it.

Modifying Coverage Levels

One alternative to cancelling a car insurance claim is to modify the coverage levels of your policy. For example, if you initially filed a claim for comprehensive coverage but now realize that it may not be necessary, you can adjust your coverage to a lower level such as liability only. This can help reduce your premium costs and avoid cancelling the claim altogether.

Adjusting Deductibles

Another way to modify a car insurance claim is by adjusting your deductibles. If the deductible amount for your claim is too high and causing financial strain, you can consider increasing or decreasing the deductible amount to better align with your budget. This can help you proceed with the claim without having to cancel it entirely.

Opting for Repairs Instead of Cash Payout

In some situations, you may have the option to opt for repairs instead of a cash payout for your claim. If the damage to your vehicle is repairable and you prefer to have it fixed instead of receiving a payout, this can be a viable alternative to cancelling the claim. This way, you can still address the issue without going through the process of cancelling the claim.

Last Recap

Conclusively, navigating the realm of canceling car insurance claims requires careful consideration of various factors. By understanding the process, reasons, and alternatives, individuals can make well-informed choices that best suit their needs.

Key Questions Answered

Can I cancel a car insurance claim after it has been filed?

Yes, you can cancel a car insurance claim after it has been filed. However, there may be implications or consequences depending on the insurance provider’s policies.

What are the common reasons for cancelling a car insurance claim?

Common reasons for cancelling a car insurance claim include finding a more cost-effective solution, repairing the damage out-of-pocket, or avoiding potential premium increases.

Is modifying a car insurance claim a better option than cancelling it completely?

In some cases, modifying a car insurance claim might be a better option than canceling it completely. This can help in adjusting coverage or details without entirely withdrawing the claim.